Class 11th - Priti Morjaria

Duration:1 years

Batch Type:Weekend

Languages:English

Class Type:Online

Course Fee:

Course Content

📘 Module 1: Introduction to Accounting

Topics Covered

What is Accounting?

Purpose & Importance in Business

Bookkeeping vs Accounting

Types of Accounts

Debit & Credit Rules

Accounting Terminology

📗 Module 2: Accounting Concepts & Principles

Topics Covered

Double Entry System

Golden Rules of Accounting

Matching Principle

Accrual vs Cash Basis

Conservatism

Consistency & Materiality

📘 Module 3: Journal, Ledger & Trial Balance

Topics Covered

How to record Journal Entries

Posting to Ledger Accounts

Creating Trial Balance

Identifying and fixing errors

Practical exercises

📗 Module 4: Subsidiary Books

Topics Covered

Purchase Book

Sales Book

Cash Book (Single, Double & Triple Column)

Purchase & Sales Return

Petty Cash Book

📘 Module 5: Bank Reconciliation Statement (BRS)

Topics Covered

Purpose of BRS

Causes of Differences

Preparing the BRS with examples

Real-world BRS practice

📗 Module 6: Depreciation Accounting

Topics Covered

Straight Line Method

Written Down Value Method

Asset Disposal

Practical Depreciation Calculations

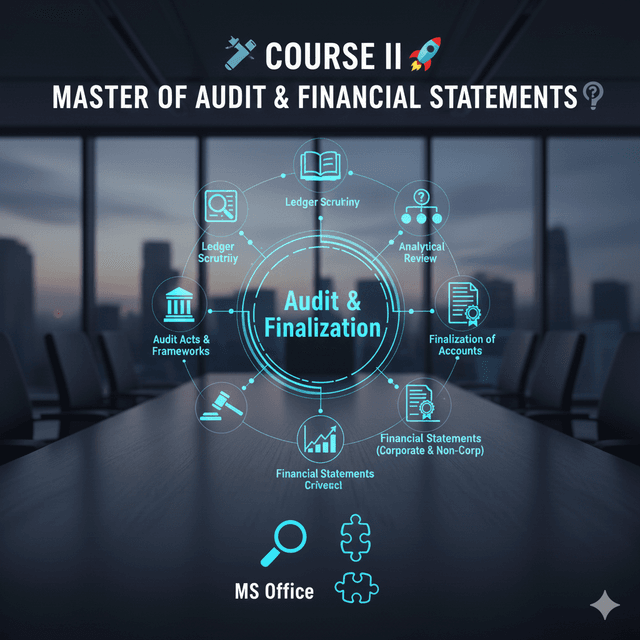

📘 Module 7: Final Accounts Preparation

Topics Covered

Trading Account

Profit & Loss Account

Balance Sheet

Adjustments (Prepaid, Outstanding, Accrued, Bad Debts)

Closing Stock

Gross Profit & Net Profit

📗 Module 8: Inventory & Cost Management Basics

Topics Covered

Stock Valuation

FIFO, LIFO, Weighted Average

Inventory Recording Methods

Basics of Costing

📘 Module 9: GST & Tax Basics for Bookkeepers

Topics Covered

Concept of GST

CGST, SGST, IGST

Input Tax Credit

GST Invoice Structure

Filing Basics & Compliance

📗 Module 10: Payroll & Salary Register Basics

Topics Covered

Payroll Components

Salary Breakup & Deductions

PF / ESI Basics

Making Payroll Sheets

📘 Module 11: Bookkeeping Software (Optional Add-on)

(Can be added based on learner requirement)

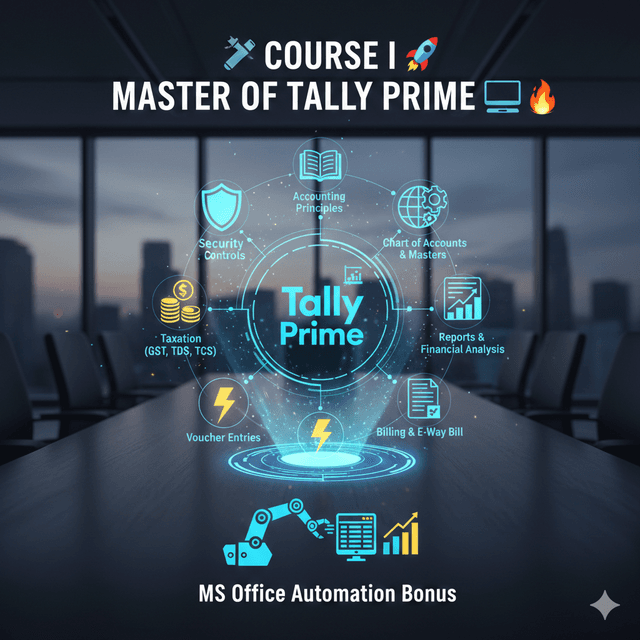

Tally Prime Foundations

Tally Entries & Reports

Excel for Accounting

Accounting Templates

Skills

Accounting and Bookkeeping

Tutor

0.0 Average Ratings

0 Reviews

8 Years Experience

Geet Gurjari Society near airport