Bipin Parmar

Accounting and Bookkeeping,Audit,Audit & Assurance,Bookkeeping & Accountancy,E-invoicing Gst,Goods and Service Tax,Gst,Gst & Income Tax,Gst and Law,Gst Filing and Income Tax Filing,Gst Law,Gst Practical,Gst Registration,Gst Return Filing Training,Gst Tally,Gst Tds,Income Tax,Income Tax Law and Computation,Income Taxation,Practical Accounting,Tally,Tally Prime,Tcs,Tds

Ratings 0.0 (0 Ratings)

Total Students 0

Experience 14 Years

Location Mumbai

About Bipin Parmar

🚀 Master Tally Prime & the Art of Finance & Compliance with a 14+ Year Pro! 💼📊

🎯Are you struggling to bridge the gap between textbook theory and real-world financial expertise? Whether you’re a commerce student aiming for the big leagues or a professional looking to sharpen your edge, learn from someone who has lived and breathed Accounting in Tally Prime, Finance, Audit, and Direct & indirect Taxation for over a decade!

👨🏫 Why and what you Learn with Me practically?

I don’t just teach subjects; I build industry-ready experts. With 14+ years of hands-on experience in Statutory Audits and GST frameworks, I bring the boardroom into the classroom. All the courses offered below are practical course.

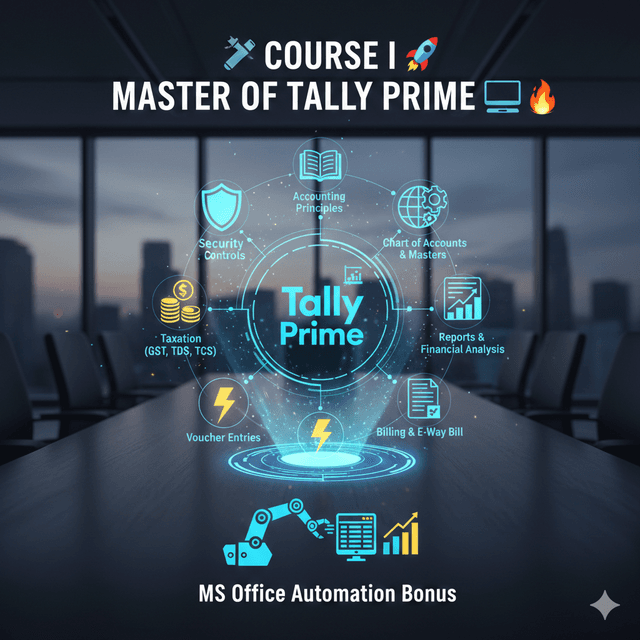

🛠️ Course I : Master of Tally Prime 💻🔥

Introduction: Intro to Tally prime, create, alter, delete company, Tally vault, Security controls, Backup, restore, split data. 🛡️

Accounting: Learn basic accounting principles & concepts, rules, methods, double entry accounting system. 📚

Taxation: Learn basic GST, TDS, TCS principles & Concepts and its relevance in accounting. 💰

Chat of accounts: Create, alter, delete accounting masters like Groups, ledgers, voucher types, cost centers, currencies and inventory master like stock groups, items, categories units, godowns, GST, TDS / TCS setup practically. 🌍

Voucher Entries: Create, modify, delete voucher entries in voucher types Contra, Payment, receipt, Journal, stock journal, Sale, Purchase, Credit note, Debit Note with / without Inventory, GST, TDS and TCS, practically. ⚡

Billing: Generate and print E-invoice, E-way bill, normal bill with / without inventory, with / without GST for Sale, CN, DN. 🧾

Reports: Learn Trial balance, Profit & Loss, Balance sheet, statutory reports, Accounting and inventory reports, registers, books, daybook, ban book. 📈

Bonus: Get hands-on training in MS Office to automate your workflow and become Tech-Savvy Accountant. 🤖

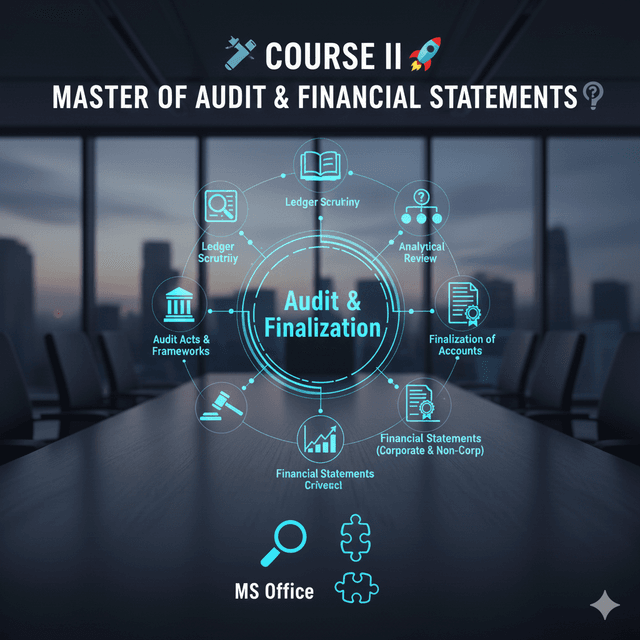

🛠️ Course II : Audit, Finalization Financial statements 🧐

Introduction: Intro to various Acts of Audit, Financial statement frameworks, finalization of books of accounts. 🔍

Ledger Scrutiny: Learn how to do ledger scrutiny of any type of books of accounts practically. 🕵️♂️

Analytical Review: Learn how to review books of accounts analytically to find queries and solve the issues. 🧩

Finalization: Learn how to do complete audit and finalization of books of accounts. 🏢

Financial Statements: Learn how to prepare financial statements of corporate and non-corporate entities. 📝

🛠️ Course III : Good and Service Tax 🏛️✅

Introduction: Intro to GST Law and provisions. 🔍

Registration: Learn how to apply for GST registration, cancellation, amendment in registration. 🔄

GST Documents: Learn how to generate E-invoice, E-way Bill and other docs under GST law. 📦

GST Returns: Learn monthly / quarterly GST return GSTR-1, IFF, GSTR-3B, CMP-08. 📮

GST Reconciliations: Learn Output, Input, RCM GST reconciliations with books and GST returns. ⚖️

GST Annual Return & Audit: Learn GST Annual in Form GSTR-9 and GST Audit in Form GSTR-9C, GSTR-4 🗓️

GST Litigation: Understanding GST notices and departmental GST Audit. 🛡️

🛠️ Course IV : Tax Deducted at Source (TDS) Tax Collected at Source (TCS) 💰

Introduction: Introduction to TDS and TCS provisions. 🌐

TDS / TCS Registration: Learn how to apply for TDS / TCS registration TAN no and registration on TRACES and Income Tax.🔄

TDS / TCS Rate Chart: Understand applicable TDS / TCS rate chart for the year. 🧾

TDS / TCS payment: Learn how to make TDS / TCS payment including interest late fees, penalty with due date.🧮

TDS / TCS Return: Learn to file TDS / TCS returns in Form 24Q, 26Q, 27Q, 27EQ and 26QB.📑

TDS / TCS correction: Learn how to make correction or revision of TDS / TCS form online and offline. 🛠️

TDS / TCS Reports: Learn How to generate TDS / TCS certificates, Justification report, Conso file. 📩

Remittance: Learn how to file Form 15CA / CB. ✈️

🛠️ Course V : Income Tax Return 🏠📉

Introduction: Introduction to income tax law, Basic concepts, Previous year Assessment year.🏛️

Assessee and status: Types of assessee, residential status, 🌐

Taxation of Assessee: Gross total income, total income, rate of tax, surcharge, Health and education cess, Rebate 87A. 💸

5 Heads of income: Income from Salary, Income from House Property, Income from Capital Gain, Income from Business, Income from Other sources. ✋

Set off & Carry f/w Loss: Learn interthread intra-head set off rules under income tax Act

Deductions: Deductions from gross total income

Advance Tax & Payment: Learn how to calculate advance tax and make payment of advance tax, self-assessment tax.📅

ITR filing: Learn Income tax return ITR-1 to ITR-7 filing. 📑

💡 What’s in it for You?

In the world of finance, accuracy is the currency. I’ll teach you how to spend it wisely💎

Practical Case Studies: No more "boring" theory. We analyze real case studies.

End-to-End R2R: Learn the full "Record-to-Report" cycle and finalize books like a professional CA.

Corporate Secrets: Master Audit and prepare financial statements like a pro.

Career Transformation: Go from a student to a high-value professional who can manage A to Z work from accounting to Tax with ease.