Tally Prime GST TDS Income Tax Zohobooks

Duration:1 hours

Batch Type:Weekend and Weekdays

Languages:English, Hindi, Marathi

Class Type:Online and Offline

Address:Virar West, Mumbai

Course Fee:Call for fee

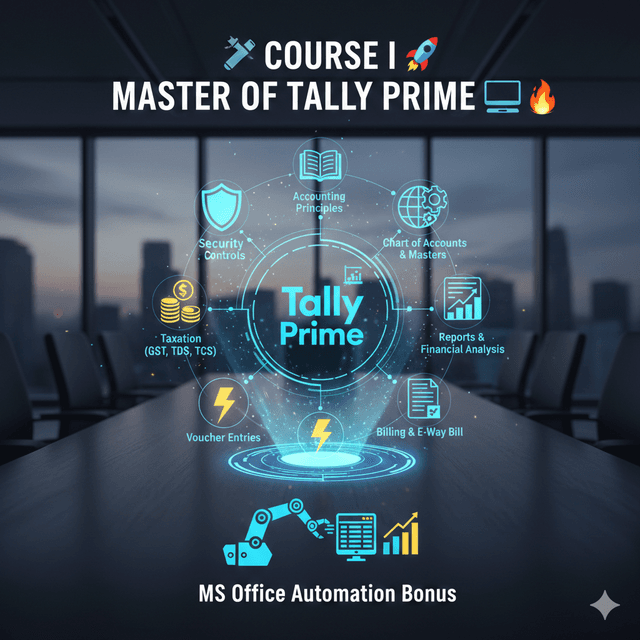

Course Content

The Online Tally Prime, GST, TDS & Zoho Books Training by Sayali Naik is a flexible, student-focused course designed to meet individual learning requirements in accounting and taxation. Ideal for students, professionals, and small business owners, this program covers practical accounting, taxation, and bookkeeping software to help learners manage financial tasks efficiently and accurately.

The course emphasizes customized learning, ensuring that each student’s specific goals—whether mastering Tally Prime, handling GST/TDS, understanding Income Tax, or using Zoho Books—are addressed in a structured, practical way.

What Students Will Learn

Depending on individual requirements, students can expect to learn:

Tally Prime: Accounting basics, ledgers, inventory, and reporting

GST Compliance: Filing, calculation, and practical applications

TDS Management: Calculation, deduction, and reporting

Income Tax: Basics of personal and business taxation

Zoho Books: Accounting software for bookkeeping, invoicing, and financial management

Practical accounting techniques for business and professional use

Real-world examples to enhance understanding of financial operations

The course is designed to ensure learners apply accounting concepts effectively, prepare for exams, or manage finances professionally.

Teaching Method

This is a fully online course with a flexible, student-centric approach. The teaching methodology includes:

Custom-designed sessions based on student requirements

Step-by-step guidance on accounting, taxation, and software usage

Practical demonstrations and hands-on exercises

Personalized doubt clearing and feedback

Focus on real-world application for career or business purposes

Students will gain confidence in using Tally Prime, GST compliance, TDS, Income Tax, and Zoho Books for professional or personal purposes.

Who Can Join

Students pursuing accounting or finance studies

Working professionals aiming to improve practical accounting skills

Entrepreneurs or small business owners needing financial management skills

Beginners seeking structured guidance in Tally, GST, TDS, or bookkeeping software

Benefits / Outcomes

By completing this course, students will:

Master Tally Prime and Zoho Books for accounting and bookkeeping

Gain practical knowledge of GST, TDS, and Income Tax compliance

Develop skills to manage business finances independently

Build confidence in using accounting software and performing real-world accounting tasks

Receive a customized learning experience tailored to individual goals

This course is perfect for anyone looking to learn practical accounting and taxation skills online with personalized guidance.

Skills

F1 - Accountant in Business, Zoho Books, Gst, Income Tax, Income Taxation, Practical Accounting, Tds, Tally Prime, Tally

Tutor

Sayali Naik is an experienced accounting and taxation trainer based in Mumbai (Virar West) with 8 years of teaching experience. She specializes in...

0.0 Average Ratings

0 Reviews

8 Years Experience

Karmala